10 Years of Financial Literacy Month

Consolidated Credit to share resources during Financial Literacy Month

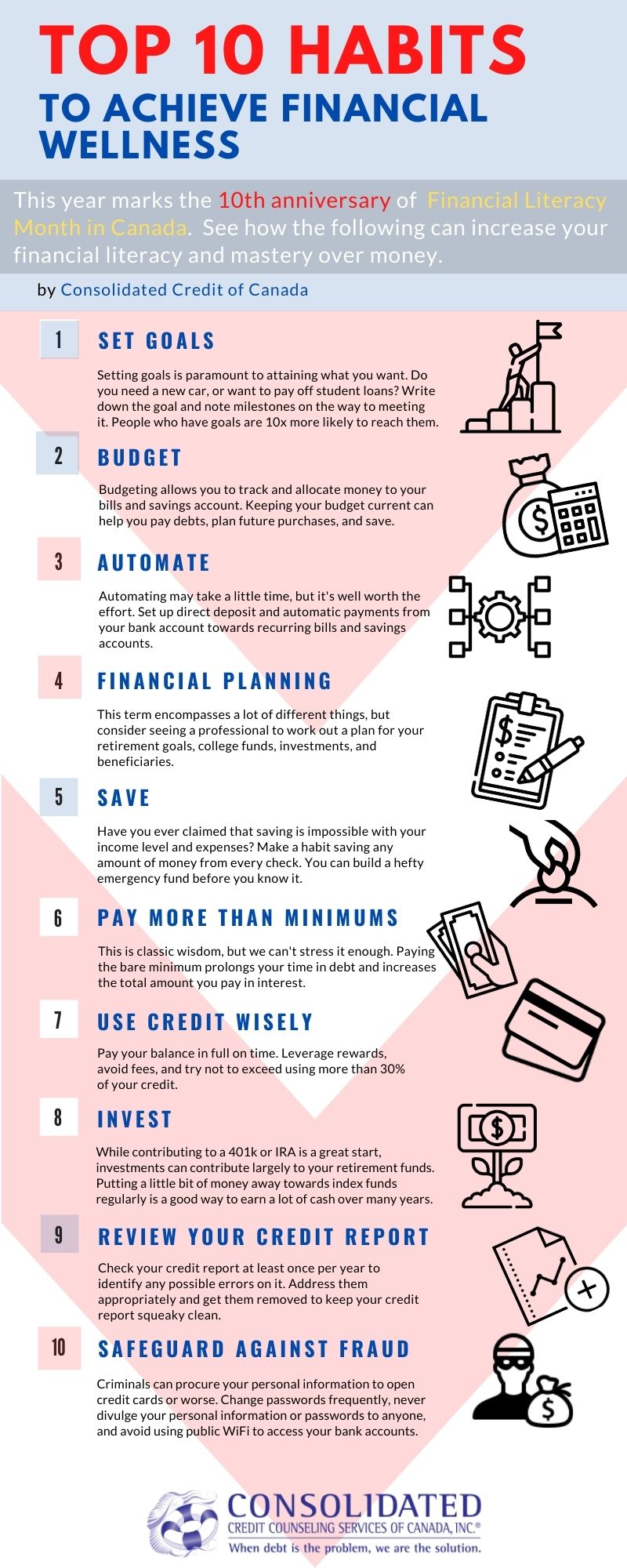

Financial Literacy Month is here, and Consolidated Credit Counseling Services of Canada is hoping for a “paradigm shift” in Canadian financial literacy. The not-for-profit credit counselling organization wants to be “counted in” the national effort to financially empower Canadians.

“Now more than ever, we need a paradigm shift in the way we manage money,” says Jeff Schwartz, executive director of Consolidated Credit. “I have to believe that a large portion of the financial hardship in Canada could be avoided if people had a solid foundation of financial literacy.”

Over the month of November, Consolidated Credit is sharing free financial tools and resources via Facebook using the Financial Consumer Agency of Canada’s (FCAC) hashtag #FLM2020.

Schwartz points out that Consolidated Credit has helped over 500,000 Canadians tackle their debt, and many times, true success relies on better budgeting and careful financial planning.

“Oftentimes our clients simply need to empower themselves to make better use of their income,” notes Schwartz. “The tools are out there for us to free ourselves from the shackles of debt; we just need to plant that financial literacy seed.”